Internal Audit

Internal Auditing is an independent, objective assurance and consulting activity designed to add value and improve an organization’s operations. It helps an organization accomplish its objectives by bringing a systematic, disciplined approach to evaluate and improve the effectiveness of risk management, control, and governance processes.

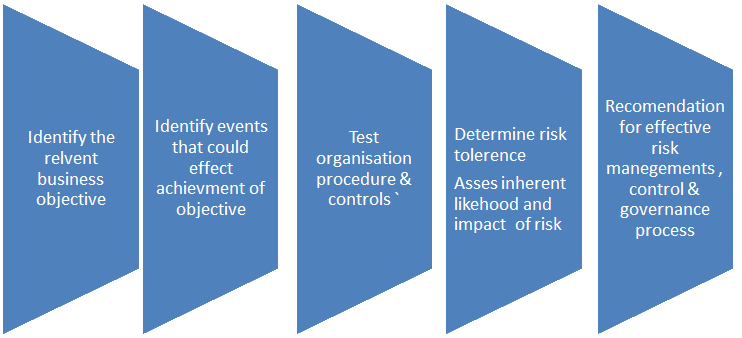

Our Risk based Approach to Internal Audit

Want to learn more about our approach

Internal Control

Operational Control

Financial Control

Process Study

Variance Analysis

Analytical Review

Virtual CFO

We offer this service suite to the clients to save cost of hiring high paid CFO’s on their roll. It also brings in effective decision making mechanism by accumulating knowledge of professionals from different fields. Our professional team functions as a virtual CFO for our clients and executes financial operations independently. Our team accesses the full array of financial management techniques to craft carefully targeted financial solutions for our clients.

These solutions are categorized as:

- Control ship: Designing, executing and monitoring SOP’s.

- Finance and Treasury : Analyzing financial position, investment decision, risk-return analysis, capital structure, asset management, managing cash and bank transactions.

- Strategy: Visualizing future economics and defining financial plans.

- Forecasting: Preparing budgets, study and reports on reconciliations with actual.

Forensic Audit

Fraud Risk Management

Managing the risk of frauds is the growing area of concern for the management and shareholders in today’s business environment. Organization should recognize the specific fraud risks that can threaten their financial and reputational stability. A structured fraud risk assessment program helps the management to understand the specific fraud risks.

We are specialists in the investigative accounting and have a unique set of skills that are not found in any other discipline. They combine knowledge of complex financial transactions with an understanding of law, criminology, investigation and how to resolve allegations of fraud.

We identify the fraud risk in various areas in the balance sheet.

Purchases

Sales

Inventory

Payroll

Expenses and other sectors which are customizable.

Financial fraud related investigations bear few similarities to traditional audits. In the simplest terms possible, it is fair to say that traditional auditing seeks to verify things that are known to be fraud-specific investigations seek to determine the existence of things that are not known to be and may not be.

It differs from financial auditing. They go beyond the numbers. Specially trained forensic accountants require investigators with the mind set to focus on the exceptions, the odd trends, accounting irregularities and patterns in data, not just on errors and omissions. Typically, corporate investigations involve a large number of documents– including electronic evidence–that often contain the facts on which the successful outcome of the case may rely. Our senior professionals are skilled at organizing, managing and identifying documents to assist a company in analyzing the relevant facts and evidence. However, documents do not generally answer all questions, so additional interviews with employees and others with specific knowledge of the transactions may be required. Our team of fraud investigators includes former law enforcement and prosecutorial personnel who have strong interview skills and are extremely adopt at exposing fraud schemes and helping to expedite recoveries. In addition, understanding the client’s business and the relevant issues enables our people to access the issues in light of the business and corporate environment in which a company is operating, its financial condition and the results of its operations.

Outsourcing Services

In today’s changing global environment finance & account function are most essential for any enterprise. Due to heavy shortage of trained accountants most of the companies are outsourcing accounts & finance function to separate entity. We assist management to solve management problem by providing effective & value added account & finance outsourcing services.

Audit & Compliance

Auditing is the independent examination of financial information of any entity, whether profit oriented or not, and irrespective of its size or legal form, when such an examination is conducted with a view to expressing an opinion there on. We provide Audit & Compliance services under various Indian act. We not only reduce the organization regulatory risk but also provided value addition to organization through our audit techniques.

Taxation

Managing a Tax issues is difficult task for companies operating in Indian regulatory environments. We have team of experts providing the advisory services in the fields of Direct Tax & Indirect Tax. We provided effective tax planning solutions in the field of Direct Tax & Indirect Tax.

Management Consultancy

In today’s competitive world the organization are facing lot of problems for taking business decisions. We provided third eye to the management for decision to be taken. Our expertise in the field of finance & having exposer to the variety of business models and industry we provided structural solution of effective decision making. Our analysis concentrate on management procedure of decision making and its impact on overall organization performance and objective.

Project Financing

Project finance is the long-term financing of infrastructure and industrial projects based upon the projected cash flows of the project rather than the balance sheets of its sponsors. We assist you to satisfy your financial needs by providing effective financial solution to your organization. We also assist management in restructuring there debt structure to enjoy low finance cost & to have effective financial leverage.